A subsidiary is a company which is owned or controlled by another company, named the parent or holding company. Mexico is the ideal place to set up a subsidiary because it is ranked the 12th largest economy in the world (measured for the last quarter of 2023), having 77% of its population living in urban areas.

In this article, our Mexico company formation consultants provide a few key details related to opening a subsidiary in this country.

How a subsidiary can be opened in Mexico in 2024

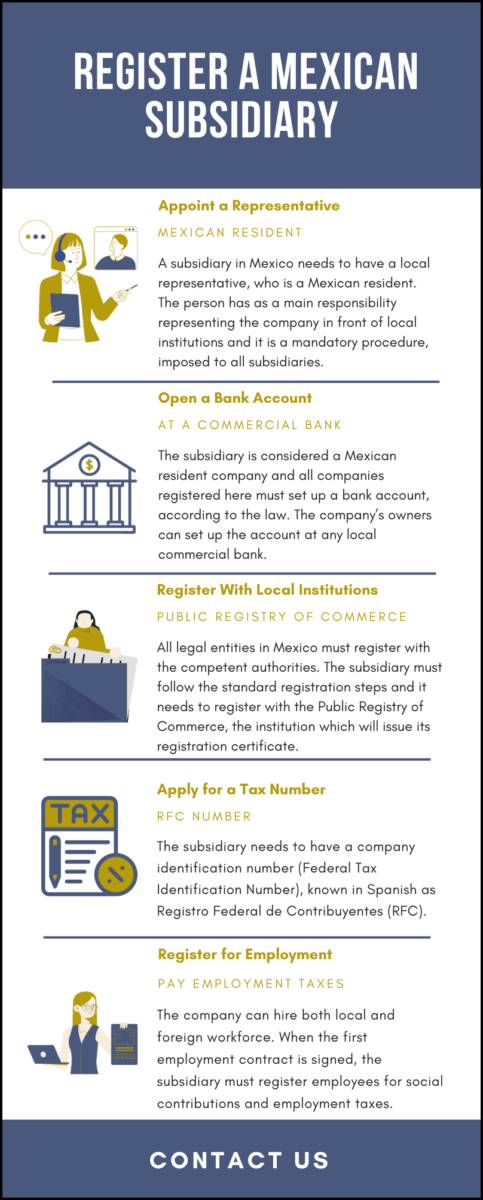

To open a subsidiary in Mexico, it is required to obtain an authorization from the local government first. Also, a fee in the value of around USD 100 has to be acquitted to the Mexican government.

An important aspect that should be clarified for foreign investors who want to open a company in Mexico as a subsidiary is that this entity is an independent structure from its parent company.

| Quick Facts | |

|---|---|

| Best used for |

The subsidiary is a suitable vehicle for expanding on a foreign market, while the parent company enjoys limited liability for local debts and other associated business risks. In Mexico, foreign investors can establish their desired level of independence for the subsidiary (the entity can have 51% to 100% parent shareholding). |

|

Registration obligations for taxation |

In order to set up a subsidiary in Mexico it is required to apply for a tax identification number (Federal Tax Identification Number – Registro Federal de Contribuyentes – RFC) issued by the Mexican Tax Administration System (Secretaria de Administracion Tributaria). The subsidiary is liable to corporate taxes charged in Mexico, therefore it must make all the necessary tax registration steps. |

|

Minimum share capital |

No minimum capital requirements. |

| Institution in charge with the incorporation | The Public Registry of Commerce handles the registration of all legal entities. |

| Penalties |

The Mexican tax institutions charge penalties for late tax returns and late tax payments. |

| Management (Local/Foreign) |

Investors can set up a subsidiary in Mexico with 100% foreign management, as per the rules of Article 4 of the Mexican Foreign Investment Law. |

| Legal representative requirements |

It is necessary to have a person who is a Mexican resident to represent the company in the relation with the state authorities. |

| Local bank account setup procedure |

– present information on all the persons representing the company (shareholders, directors, legal representative); – submit the incorporation documents of the company; – present details on its corporate name, business address, tax identification number; – appoint a person who can use the account that will be set up at the commercial bank of choice; – complete bank forms, etc. |

| Independence from the parent company |

Yes, the company is a separate legal entity from the parent company. |

| Liability of the parent company | Limited to the amount of shares owned (minimum 51% and maximum 100%, for wholly owned subsidiaries). |

| Corporate tax rate |

30% |

| Annual accounts filing requirements |

If you will set up a subsidiary in Mexico, you will need to: – file a corporate income tax return on a monthly and yearly basis (by 31 March of the next financial year); – file information returns on loans, transactions, withholding taxes, donations, dividend payments (by 15 February of the next year); – comply with audit procedures (for companies required to complete audit formalities); – submit audit reports, etc. |

| Possibility of hiring local staff (YES/NO) |

Yes |

| Travel requirements for incorporating branch/subsidiary (YES/NO) |

No (legal representation is possible through the power of attorney). |

| Number of double tax treaties signed by Mexico (approx.) | 60 double tax treaties. |

Even though it belongs and it is founded by the parent company, the subsidiary has autonomy in many aspects, unlike the branch office, which is fully dependent to its parent.

The subsidiary must be incorporated as a separate legal entity in accordance with the Mexican corporate laws. For this, the investors should decide on a suitable business form.

In general, 2 options are commonly associated with the incorporation of a subsidiary: 1) the public limited company and 2) the limited liability company.

According to the Mexican Foreign Income Law, a company can be considered a subsidiary as long as 51% of the capital of the company is subscribed by the parent company, which has to be the subsidiary’s major shareholder.

Please mind that the law for company formation in Mexico allows foreign investors to own 100% of the company’s shares. Some limitations can appear depending on the business field in which the company operates.

In order to be issued this permission, a declaration must be filed with the Ministry of Economy. This declaration includes the incorporation documentation of the parent company legalized or duly apostilled by the Embassy or Consulate of Mexico in the foreign company’s home country.

The above-mentioned declaration has to be translated by an officially certified translator. Moreover, a letter addressed to the local government has to be made, which will be comprised of:

- a written declaration which states that the parent company is incorporated in compliance with the legislation in its country of origin and that its by-laws are not against the public order;

- an explanatory statement of the activities which the subsidiary will be undertaking;

- the physical address for the commercial subsidiary activities.

Our company formation advisors in Mexico can offer more details on the registration procedure necessary to set up a subsidiary in this country. We also provide assistance to open any type of company in Mexico.

What is the tax system applicable to a subsidiary in Mexico?

Investors who want to set up a company in Mexico should know that all entities that obtain an income from commercial activities are taxed following specific rules.

Thus, tax obligations and tax reporting obligations will appear in the case of a subsidiary as well. In most of the cases, subsidiaries in Mexico must comply with the same tax obligations as local companies.

This is due to the fact that the subsidiary is a Mexican incorporated company. So, unless stated otherwise by specific rules of law, subsidiaries must pay the same corporate taxes.

Specific tax deductions can appear when the company qualifies as a foreign controlled entity, which can be the case of a subsidiary if certain conditions are met.

In the list below, our consultants in company registration in Mexico have prepared a short presentation on basic taxes and tax laws:

- a foreign controlled entity that qualifies as opaque can benefit from the regulations of the Mexican Income Tax Law (Articles 176 and 177, which prescribe a preferential tax regime);

- the corporate tax is charged at a rate of 30%;

- withholding taxes on dividends are charged at a rate of 10%;

- the withholding tax on royalties is charged at rates of 10% or 15%, when they are paid to nonresident entities;

- social security contributions are paid by the employer, and it is capped at MXN 188,657 per year per 1 employment contract (the value varies based on the salary of the employee).

With regards to salary matters, it must be noted that companies operating in Mexico and those who will expand on the Mexican market in 2024 have to comply with new basic salary requirements, as, from 1 January 2024, the minimum salary has been increased.

There are 2 main salary modifications for 2024. The 1st one refers to the Free Zone of the Northern Border, where the minimum salary per 1 day of work is, starting with 1 January 2024, MXN 374,89, and the 2nd one, applicable to the rest of the country, is MXN 248,93 per day. The salaries have been increased by 6% and for some professions, the salary increase can go up to 20% in the near future.

What are the compliance obligations in Mexico?

Whether one wants to open a company in Mexico as a subsidiary or a branch office, certain tax compliance procedures should be concluded in all cases. In Mexico, tax compliance is based on the accounting rules and the tax year.

The subsidiary is required to comply with the same types of accounting regulations that are imposed to a regular company operating in this country. Our accountants in Mexico can present the main obligations a subsidiary will have.

As a general rule, the subsidiary is required to pay the general company taxes charged to local businesses, such as the corporate tax, the VAT, the employment taxes, etc.

A tax year in Mexico is the calendar year and all corporate structures will have various tax obligations throughout the year.

Companies are required to pay the tax on their corporate income based on a self-assessment regime. Thus, advance corporate tax payments have to be made in 12 installments, 1 for each month of the year.

It is also mandatory to submit an annual tax return and the deadline to submit it is within 3 months (the 1st quarter) since the beginning of the new financial year.

Delays in the payment of the taxes due will be charged with penalties. All companies must submit their tax returns with the Tax Authority.

Taxes collected as social security contributions must be submitted with the Mexican Social Security Institute.

Foreign investors have to be aware of the fact that although Mexico offers multiple business benefits, the country lacks in digitalization services and because of this, most of the registration procedures are completed in person.

The investors are generally required to travel to Mexico in order to present various documents and to contact the local institutions for the registration procedure.

However, this can be generally avoided through the power of attorney, a legal document that grants the right of legal representation.

By signing this document, you can grant our team of consultants in company formation in Mexico with the right of representing foreign investor/the foreign company in specific registration procedures.

If you want to start a business here by registering a subsidiary, you can also address to our team for advice on the corporate documents that must be included in the application file. We also invite you to watch a video presenting how to open a Mexican subsidiary:

What are the formalities for a power of attorney in Mexico?

As stated above, there are 2 main options for the process of company formation in Mexico. The 1st is the one where the investors will participate directly in the registration formalities, and the 2nd is the one where they will be legally represented.

If the 2nd option is more suitable for investors, this means that they can be represented by our team of consultants in company registration in Mexico, who can provide the right to legal representation only if the power of attorney is signed.

The power of attorney (POA) is a legal document in which a party gives the right to representation to another party for specific activities, therefore the document will state the ways in which our consultants can offer their services.

In order to obtain the power of attorney, certain documents must be presented, as stated below:

- the passports of the persons appointed as directors of the subsidiary in Mexico;

- the proof of address of the above mentioned;

- the deed of incorporation;

- proof of a business address.

What are the advantages of a subsidiary in Mexico?

Choosing between a branch office or a subsidiary is founded based on the strategies and management structures desired by the parent company, as each of them has its own benefits and disadvantages.

When it comes to a subsidiary, investors must know that there are many advantages. Our consultants in company incorporation in Mexico have highlighted some of the maid advantages in the list below:

- it helps with the company’s brand identity in Mexico;

- operating through a subsidiary helps the parent company limit any liabilities that it can have when developing a business abroad;

- it provides bookkeeping advantages (simpler rules);

- it offers simpler accounting formalities, which can be presented by our accountants in Mexico;

- there are also tax compliance advantages (lower costs compared to operating through a branch).

What company types are available for a Mexican subsidiary?

Generally speaking, investors who will set up a company in Mexico as a subsidiary will choose the limited liability company, the business form that is most popular for incorporation in this country and anywhere else.

Currently, a Mexican subsidiary can be incorporated as one of the 4 company types presented below:

- limited liability company;

- stock corporation;

- investment promotion corporation;

- simplified shares company.

The company type selected for company incorporation in Mexico matters in many aspects, as there can be different requirements on capital, number of shareholders, types of activities the business can undertake and also, in reporting and accounting requirements.

For instance, for a limited liability company, the accounting procedures can be simpler than in the case of a stock corporation, which is designed for large companies and therefore, has many tax and reporting obligations.

If you will open the subsidiary as a stock corporation, the accounting formalities should be concluded by our CPA in Mexico, who is a type of accountant that has an in-depth expertise in accounting law, procedures, taxation, etc.

Does a subsidiary require a bank account in Mexico?

Yes, please mind that during the incorporation process you will be asked to set up a corporate bank account for the subsidiary. This step is mandatory for all company types registered here.

The setup process can take up to several weeks and you can obtain legal representation from our team for this step as well. Our consultants can offer legal assistance and representation in all the steps concerning company formation in Mexico.

If the company will need various business permits and/or licenses, our specialists can offer their services on this matter as well.

If you need to know more about subsidiaries in Mexico, or for assistance related to opening such a business structure in the country, please contact our friendly Mexico company formation executives.